what's the difference between a financial coach and a financial advisor?

Financial Coach

what does a financial coach do?

A financial coach generally works with people on the foundations for financial success, starting with your financial mindset and financial literacy.

Financial coaches focus on behavior change and helping you develop good financial habits. Then financial coaches work with you on your budgeting/cash flow, debt management, saving, and basic financial education.

Financial coaches definitely do not (or at least, should not) provide specific investment advice. An example of this would be a financial coach saying something like "You should invest in Apple stock" or "You should invest in crypto."

Financial coaches usually charge either by the session or sell coaching packages. Financial coaches also typically work with clients less than a year (usually 1-6 months at a time).

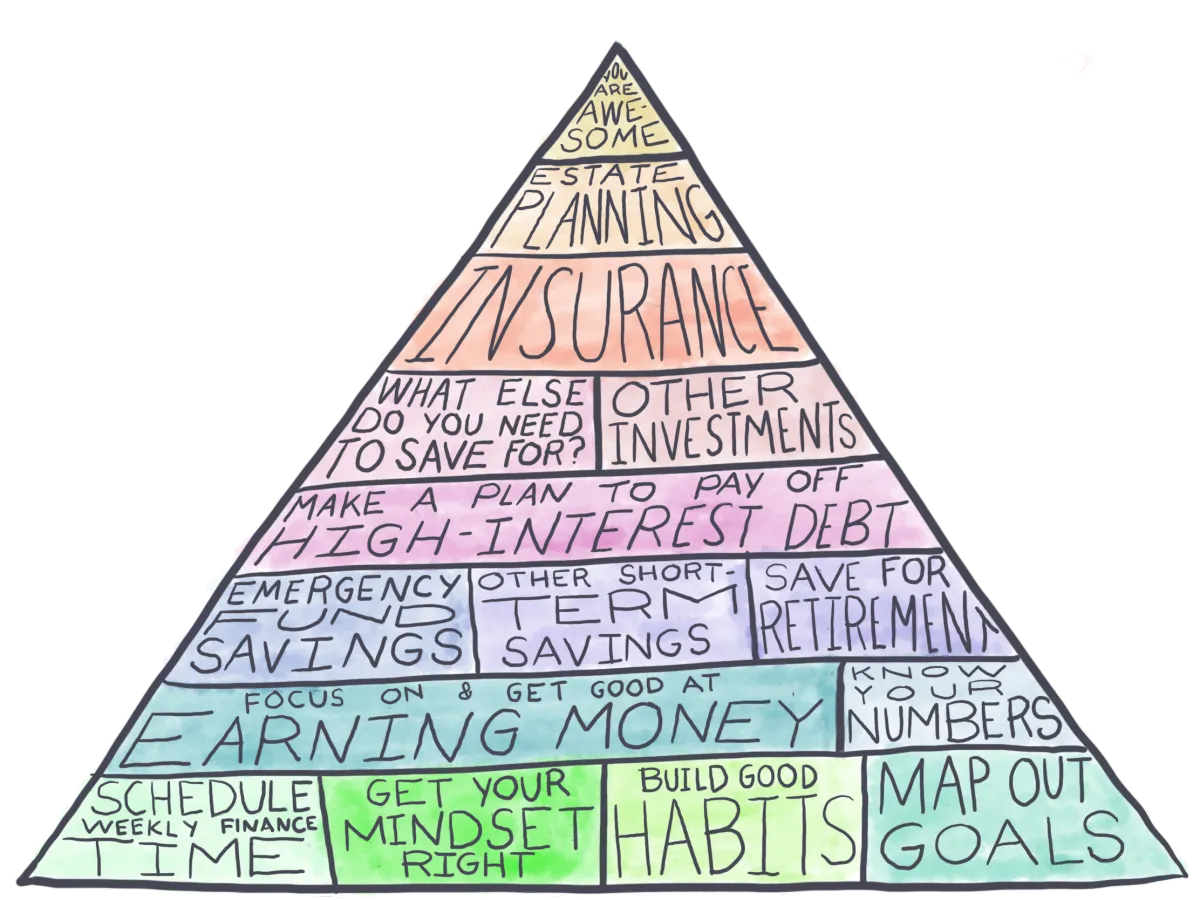

Financial coaching usually covers the bottom half of this pyramid, for example. Image credit to Finance for the People by Paco De Leon.

where do I find a financial coach?

A good place to search for financial coaches is the Find an AFC® website here - https://findanafc.org/.

AFC stands for Accredited Financial Counselor®, which is one of many certifications for financial coaches/counselors.

As you likely know, Gabbi runs That Makes Cents LLC as both the founder and financial coach - read more here.

Financial Advisor

what does a financial advisor do?

A financial advisor or financial planner generally works with people who have good cash flow already. This means that they already know how to budget and save money, and usually do not have a lot of high interest debt like credit card debt or personal loans.

Financial advisors should provide comprehensive recommendations on your entire financial life, including insurance, investing, retirement, workplace benefits, tax planning, estate planning, education planning, and so on.

Financial advisors have many different ways they charge their fees.

The most straight forward are direct fees where you pay via ACH or credit card and an investment management fee (AUM fee).

An investment management fee (or assets under management fee) is where an advisor charges you a percentage of the total amount of investments they are managing for you.

Financial planners usually cover all of these topics and more in their services. Image credit to Sustain Financial Inc.

where do I find a financial advisor?

There are a few good places to search for a financial advisor:

Find a CERTIFIED FINANCIAL PLANNER™ - https://www.letsmakeaplan.org/

Find a fee-only, fiduciary financial planner by location - https://www.napfa.org/

Find a fee-only financial planner by specialty - https://connect.xyplanningnetwork.com/find-an-advisor

Gabbi is also a CERTIFIED FINANCIAL PLANNER™ who works at Sustain Financial Inc, where she provides comprehensive financial planning to teachers and government employees. Please note that Sustain Financial Inc. is an unaffiliated Registered Investment Advisory Company.

I'm still confused about the difference...

yeah, that is totally understandable! The financial services industry is a lot to navigate!

If you're still feeling confused, set up a call and we can talk it through.

thank you to the Chumash, Serrano, Gabrielino-Tongva, Tataviam, Kizh and all people that care for the land that Gabbi lives and works on.

© That Makes Cents, LLC